salt tax deduction limit

In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for married taxpayers filing. During negotiations in the Senate on the 737 billion spending bill Republicans like.

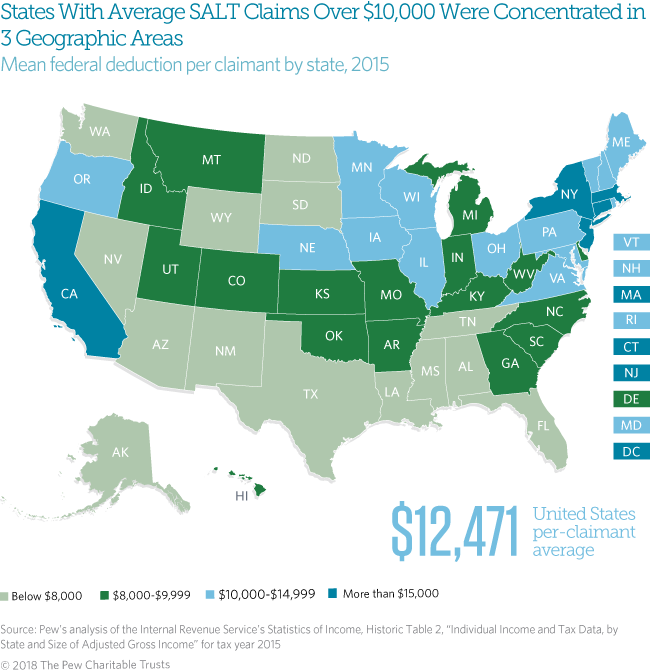

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts

Prior to the change in 2017 about 77 of taxpayers with an adjusted gross income of 100000 or more.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

. A 10000 ceiling on the previously unlimited SALT deductions was enacted and made applicable for taxpayers between 2018 and 2025. One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about 400000. 100s of Top Rated Local Professionals Waiting to Help You Today.

What is the SALT deduction limit. The Tax Cuts and Jobs Act of 2017 placed a 10000 cap on State and Local Tax SALT deductions. The SALT limit really put an unfair burden on all of our cities.

Ad Browse discover thousands of brands. The SALT deduction limit was part of a larger change to the individual income tax. The change may be significant for filers who itemize deductions in high-tax.

The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025. Guaranteed maximum tax refund. Theres now a cap on your SALT deduction The Tax Cuts and Jobs Act imposed a 10000 limit on the SALT deduction so regardless of how much you actually pay in state and.

Max refund is guaranteed and 100 accurate. House Democrats spending package raises the SALT deduction limit to 80000 through 2030. This deduction is a below-the-line tax.

Read customer reviews find best sellers. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes.

Individual taxpayers who itemize their. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. The new proposal from the Democrats raises.

This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and. The TCJA lowered tax rates and expanded the standard deduction to 12000 for single filers. Because of the limit however the taxpayers SALT deduction is only 10000.

To be impacted by the limit 3. Free means free and IRS e-file is included. The SALT Tax deduction limit or cap was set at 10000 dollars in 2017 but this was set to expire in 2026 and become uncapped.

The Tax Cuts and Jobs Act TCJA limited the amount an individual can deduct from the amount of the following state and local taxes they. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break. This will leave some high-income filers with a higher.

52 rows As of 2019 the maximum SALT deduction is 10000. Previously the deduction was unlimited. Ad Free tax filing for simple and complex returns.

Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. This means you can deduct no more than. The Tax Cuts and Jobs Act.

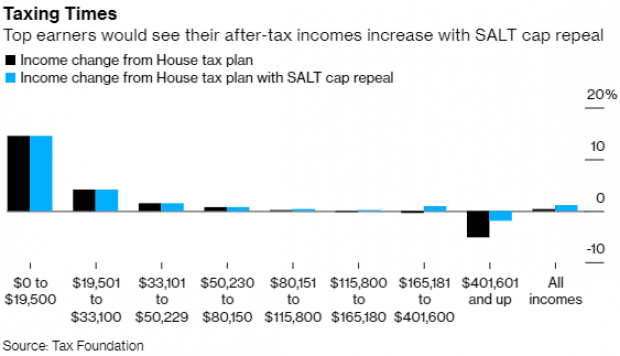

Ad Find Recommended Local Tax Accountants Fast Free on Bark. The SALT deduction benefits the high-income earners the most.

What Is The Salt Deduction H R Block

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Restoring Salt Deduction Would Slash Dems Tax Hikes For Top Earners Report

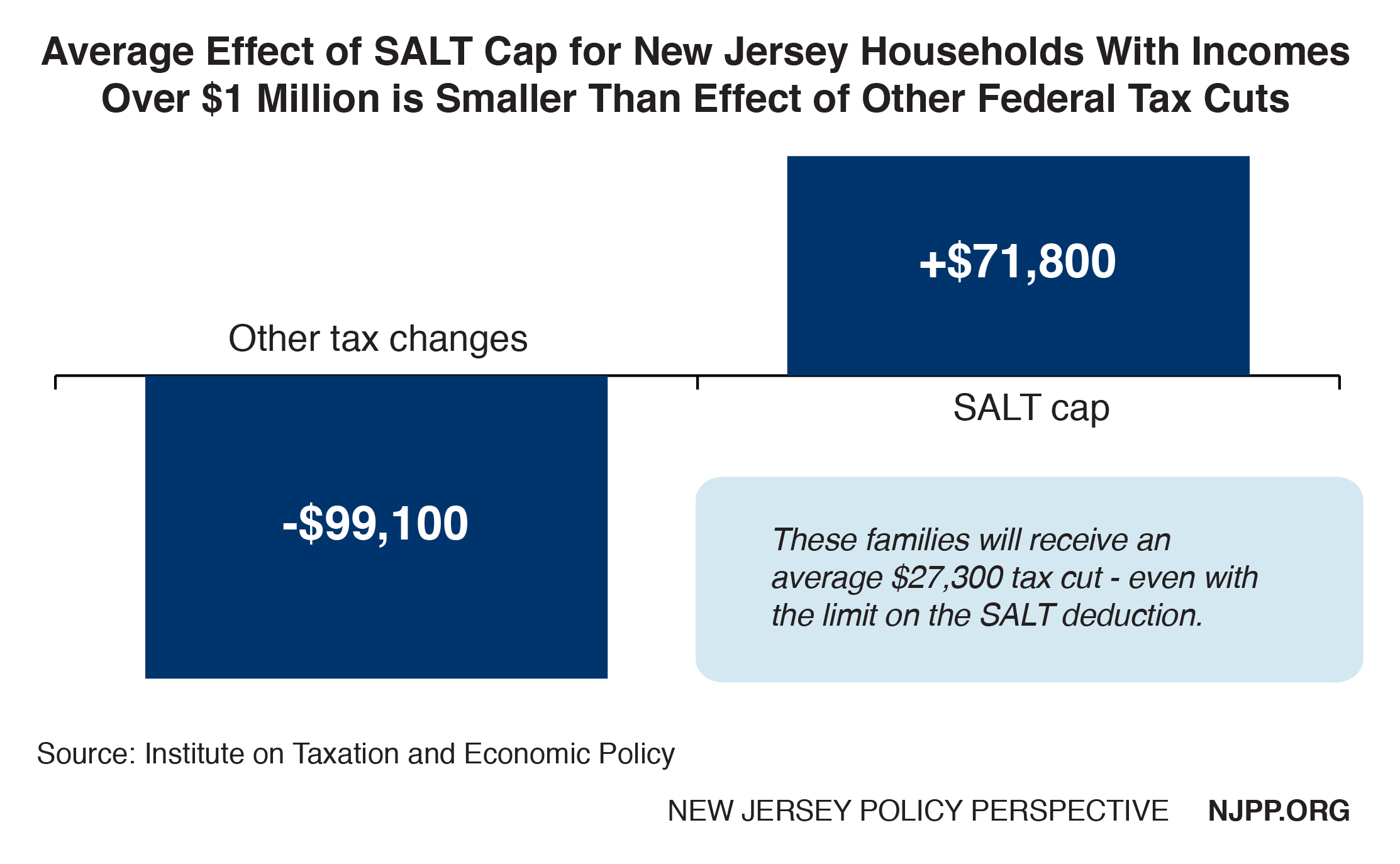

A Grain Of Salt New Jersey Needs More Than Workarounds To Respond To Gop Tax Plan New Jersey Policy Perspective

Congress And The Salt Deduction The Cpa Journal

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Salt Deduction Limits Aren T So Bad For The Middle Class Bloomberg

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

House Democrats Push For Salt Relief In Appropriations Bill

Salt Cap Workarounds Will They Work Accounting Today

What Is The Salt Tax Deduction Forbes Advisor

Congress And The Salt Deduction The Cpa Journal

These States Offer A Workaround For The Salt Deduction Limit

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

Supreme Court Won T Hear Case On Limit To State And Local Tax Deductions The New York Times

Irs Rules Block Ny Nj Attempts Around 10k Salt Tax Cap Deductions

Among The Tax Bill S Biggest Losers High Income Blue State Taxpayers The New York Times

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times